Recently, the "Digital Intelligence Driven, Open Win-Win: Fintech Empowering High-Quality Financial Development" forum was held in Shanghai, hosted by the Bank of Communications. Over 200 guests from government agencies, financial institutions, and technology enterprises attended the event, focusing on the deep integration of artificial intelligence and data elements. Discussions centered on AI large model applications in the financial sector, exploring fintech development trends and practical opportunities, providing clear directions and strategic recommendations for the industry's future. Qian Bin, a Party Committee member and Vice President of the Bank of Communications, delivered a keynote speech at the forum.

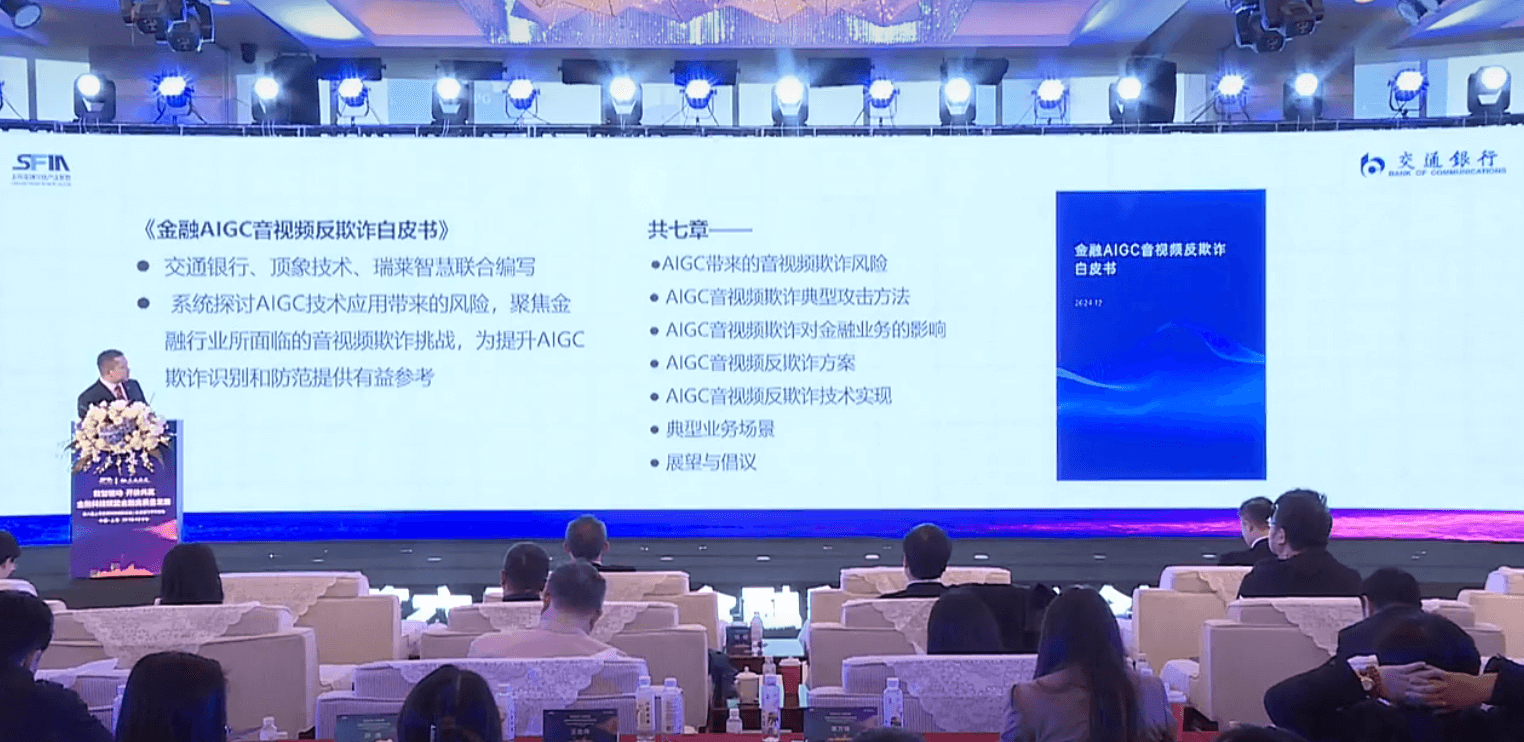

At the event, the "White Paper on Financial AIGC Audio-Video Anti-Fraud"(Click here to download the white paper for free] was unveiled. Jointly authored by the Bank of Communications, Dingxiang Technology, and RealAI, the white paper systematically discusses the risk challenges brought by AIGC technology applications, focusing on audio-video fraud issues in the financial industry. It provides references to help financial institutions enhance their capabilities in identifying and preventing AIGC-related fraud. Li Zhaoning, General Manager of the Bank of Communications’ Network Finance Department and Director of the Fintech Innovation Research Institute, gave an in-depth explanation of the white paper during the forum.

The Prevalence of AIGC Leads to Rising Audio-Video Fraud

The "White Paper on Financial AIGC Audio-Video Anti-Fraud"(Click here to download the white paper for free] elaborates on the development process of AIGC technology. Since the release of MidJourney and ChatGPT in 2022, AIGC has made rapid advancements in just two years, evolving from text-to-text and text-to-image to deep forgery and text-to-video generation. While AIGC's widespread adoption offers significant innovative potential, it has also quietly facilitated various fraudulent activities.

Examples of Global AIGC Fraud:

- January: A Hong Kong company was defrauded of HKD 200 million during a virtual meeting.

- April: An American password management company employee received a fake call impersonating the CEO.

- May: CCTV exposed an AI-generated video of an old classmate, leading to a woman being scammed for RMB 400,000.

- July: Hangzhou police disclosed that fraudsters used AI to forge facial recognition and log into others’ accounts.

- September: Fake audio of Lu Moumou from Hefei’s "Three Sheep Company" circulated widely online.

- October: A cloned voice of Lei Jun went viral during the National Day holidays.

- Recent Months: Fraudsters have increasingly exploited AIGC to impersonate relatives, celebrities, and judicial officials, particularly targeting the elderly in scams.

AIGC-based facial swapping can generate highly deceptive forged images or videos, while voice cloning enables the creation of voice content that closely mimics the target. Audio-video fraud using AIGC has become a significant risk for financial institutions, challenging business security, customer trust, and system stability.

Industry Reports Highlight Growing Risks:

- A BioCatch report revealed that nearly 70% of respondents believe criminals are becoming more proficient at using AI for financial fraud.

- The World Economic Forum (WEF) estimated that the number of forged videos is growing at an annual rate of approximately 900%.

- A Deloitte report indicated that deepfake incidents in the financial industry surged by 700% in 2023, and projected that the U.S. financial sector could lose up to $40 billion by 2027, with a compound annual growth rate of 32%.

Typical Fraud Methods Involving AIGC Audio-Video Technology

With facial swapping and voice cloning, malicious actors can engage in fraudulent activities such as mass account creation, account login, fund transfers, and loan applications. These activities directly result in significant financial losses for customers, pose severe threats to financial operations, and disrupt the normal functioning of national financial services.

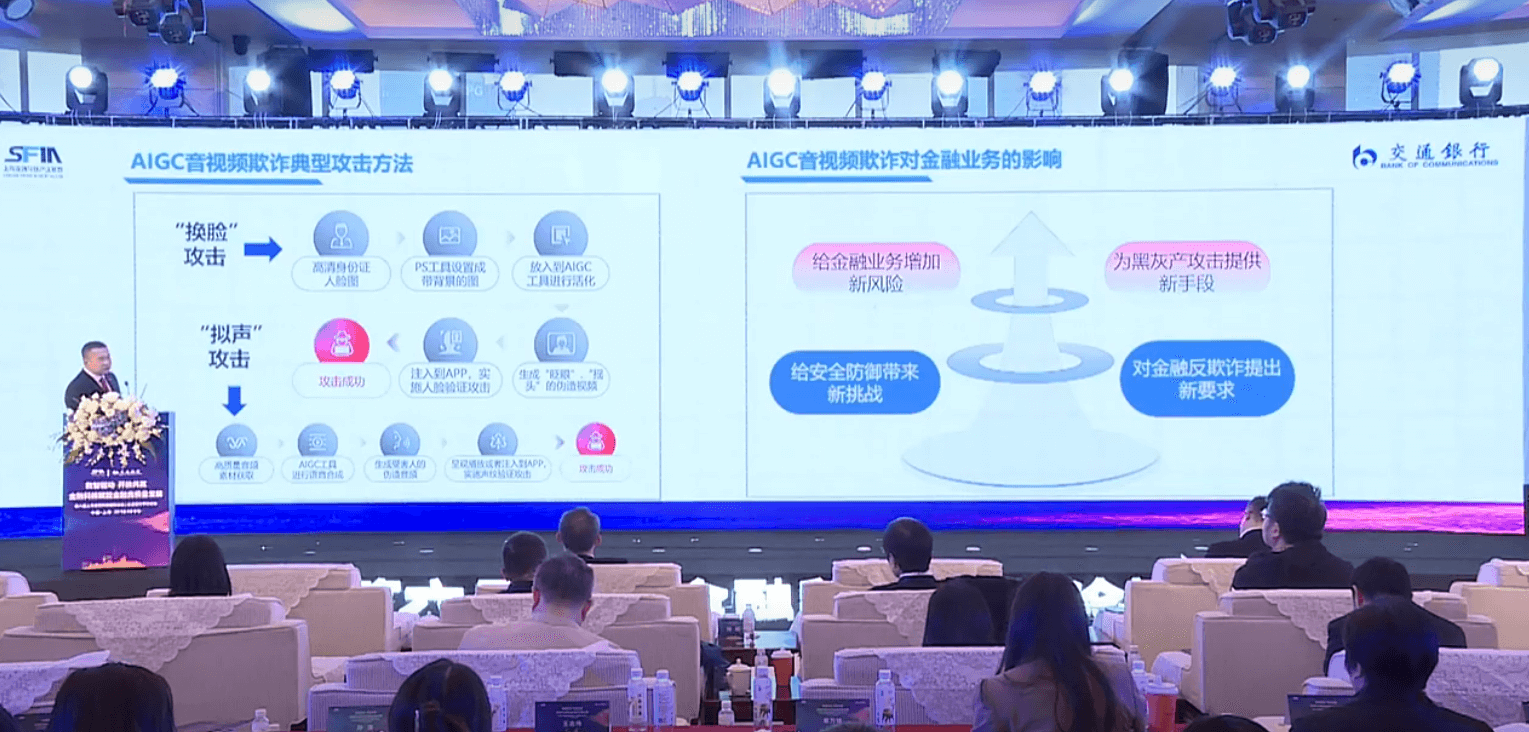

1. AIGC Facial Swapping Attacks:

- Step 1: Obtain high-definition facial images of the victim through purchased identity information.

- Step 2: Use Photoshop to prepare facial images with appropriate backgrounds.

- Step 3: Employ AIGC tools to animate the victim's photos, creating fake videos with blinking or head movements.

- Step 4: Inject the forged videos into apps to target identity authentication systems.

2. AIGC Voice Cloning Attacks:

- Step 1: Collect voice data from victims, often through telephone scam recordings.

- Step 2: Use AIGC tools to generate fake audio mimicking the victims’ voices.

- Step 3: Exploit the forged audio through playback or injection attacks to compromise identity authentication systems.

Challenges and Requirements for Financial Anti-Fraud Measures

AIGC audio-video fraud introduces new risks for financial operations, providing fresh attack methods for malicious actors. These developments present new challenges for security defenses and raise the bar for anti-fraud measures in the financial sector.

Financial Institutions Must Establish Comprehensive Defense Systems

The "White Paper on Financial AIGC Audio-Video Anti-Fraud"(Click here to download the white paper for free] urges industry players to establish a defense system that encompasses the entire lifecycle, all scenarios, and all chains to address the complex threats posed by AIGC and ensure the security of financial operations.

Technical Level

Introduce multimodal AIGC audio-video fraud detection and authentication technologies to accurately identify forged content and respond to AIGC fraud in real-time.

Personnel Level

Enhance the training of financial professionals to improve their ability to recognize and respond to AIGC-related fraud, helping institutions better manage risks.

Management Level

Establish a robust management system, optimize legal and compliance frameworks, and improve the anti-fraud capabilities of financial institutions.

Legal and Regulatory Level

Refine laws and regulations, strengthen enforcement, and enhance supervisory efficiency to ensure that AIGC technology fosters financial innovation while effectively preventing potential risks and misuse.

Multimodal AIGC Audio-Video Anti-Fraud Technology

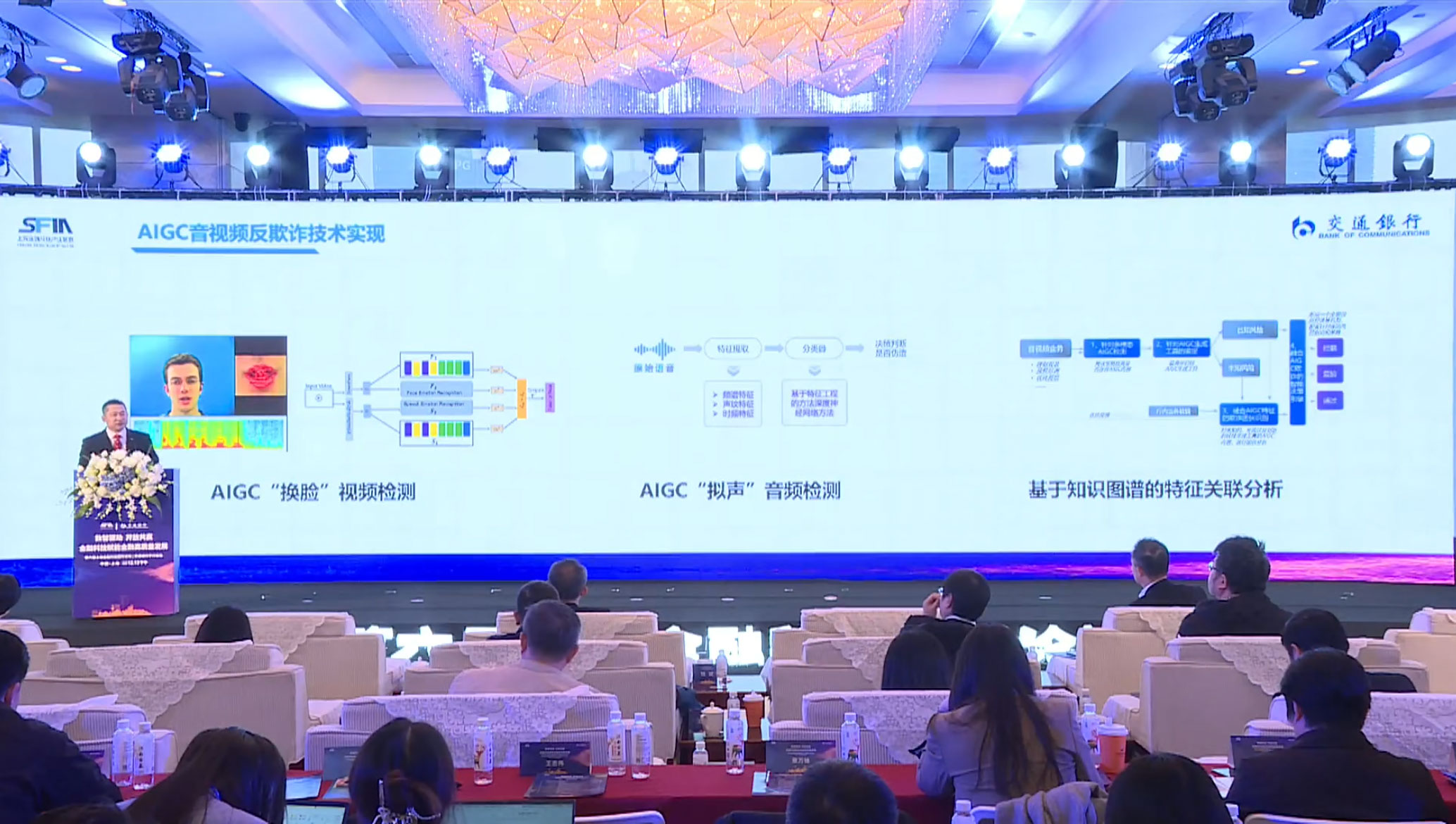

A technical defense system is one of the core elements for preventing AIGC fraud. Financial institutions should adopt advanced multimodal audio-video anti-fraud technologies, leveraging methods such as forged content detection, device correlation analysis, and user behavior identification to enhance detection accuracy and real-time responses.

Detailed Overview of Anti-Fraud Technologies in the White Paper:

-

AIGC Video Detection

This technology identifies forged video content by analyzing inconsistencies in frame segmentation and motion. It detects subtle anomalies in videos, such as distortions in facial expressions or incoherent body movements, helping financial institutions identify fake videos effectively. -

AIGC Voice Detection

Voice forgery is a common AIGC fraud method where criminals use deepfake technology to mimic others’ voices. Voice detection technology distinguishes real from generated voices by identifying abnormalities in voice spectrums and complex noise patterns, preventing impersonation and fraud through calls or video conferences. -

Knowledge Graph-Based AIGC Feature Correlation Analysis

This technology tracks potential fraud rings by analyzing connections and collaborative behaviors among multiple fraud entities. By combining graph computation and knowledge graphs, financial institutions can gain comprehensive anti-fraud strategies, enabling timely identification of cross-platform and cross-scenario fraud activities.

Real-World Applications

Many financial institutions have successfully managed AIGC-related fraud risks by combining technical defenses and manual interventions.

- Example Case: A bank's remote video service faced fraudulent attacks from malicious actors using AIGC technology. In response, the bank adopted a combination of technological defenses and manual intervention.

- Its AIGC audio detection system improved the detection rate of forged audio to 99%-100%, significantly reducing fraud risks in remote video services.

By integrating these systems, financial institutions can create a more secure environment, safeguarding their operations and customer trust.

Three Major Initiatives to Prevent AIGC Fraud

In the future, AIGC audio-video fraud is expected to become more intelligent, multidimensional, automated, and personalized. Continuous attention, early planning, and proactive responses are required. The "White Paper on Financial AIGC Audio-Video Anti-Fraud" proposes three major initiatives, calling for collaboration among governments, industries, enterprises, and institutions to establish a comprehensive, multi-layered defense system to address new challenges posed by AIGC, ensuring the security and reliability of the financial system.

Strengthen the Compliance System

- Continuously update laws and regulations to effectively suppress new risks and respond to emerging challenges.

- Refine standards for the transparency and interpretability of AIGC applications, guiding enterprises to prevent audio-video forgery risks in technological applications, business processes, and management mechanisms.

Innovate and Advance Technology

- Develop more advanced fraud detection models to combat increasingly sophisticated attacks.

- Build automated countermeasures to block large-scale fake content generated by fraud rings.

- Provide customized identity verification and risk warning services to ensure robust risk prevention while maintaining an optimal customer experience.

Build a Healthy Ecosystem

- Foster collaboration among academia, industry, and practical applications to improve the efficiency of technology transfer and rapidly defend against evolving challenges.

- Promote industry-wide sharing to support enterprises and institutions in adjusting operational strategies, algorithms, and risk assessments.

- Strengthen public awareness campaigns to enhance anti-fraud literacy, laying a foundation for trust and order within the industry.

The "White Paper on Financial AIGC Audio-Video Anti-Fraud"(Click here to download the white paper for free)is divided into seven chapters, covering the following topics:

- Risks of audio-video fraud brought by AIGC.

- Typical attack methods in AIGC audio-video fraud.

- Impacts of AIGC audio-video fraud on financial operations.

- Solutions for combating AIGC audio-video fraud.

- Implementation of AIGC audio-video anti-fraud technologies.

- Typical business scenarios.

- Future outlook and recommendations.