Risk control engine is a system based on data analysis and machine learning algorithm, which can identify and deal with various risk problems in real time. It is suitable for finance, e-commerce, intelligent manufacturing, transportation and other fields, and can improve the risk management level and business efficiency of enterprises.

Risk control engine mainly has the following functions:

Risk management: The risk control engine is used by analyzing operator behavior, transaction patterns, and historical data to identify potential fraud risks and provide timely warnings. And through the monitoring, business conditions, timely find and deal with security risks, so as to avoid heavy losses.

Transaction verification: The risk control engine can ensure the legality and authenticity of the transaction through technical verification and data analysis, such as confirming the identity of the operator, transaction validity, risk assessment, etc., and formulate security measures.

Real-time monitoring: The risk control engine can evaluate and judge the credit status of customers by analyzing customer information, historical transaction data and public databases, and through real-time monitoring of various risks, transaction abnormalities, credit evaluation, fraud detection, and remind and early warning through instant notification.

Data: An Important Component of Risk Engines

Data is an indispensable part of the risk control decision engine, including historical data, real-time risk data, behavioral data, etc., which not only provides key information and instructions, but also helps to make wise decisions. Policymakers need to analyze various data to identify optimal risk control strategies. Through continuous collection, analysis and utilization of data, the risk control engine can better understand market changes and customer needs, analyze and identify potential risk factors, achieve more accurate prediction and early warning, and then timely adjust risk control strategies.

Business data. Business data is the business data related to enterprises, including customers' personal information, transaction records, account use, etc., which can be used to evaluate user background, repayment ability, consumption habits, etc.

Government data. Government data refers to data related to government associations and other institutions, including public databases, legal files, blacklists, etc., to identify users who have recorded previous violations.

Credit investigation data. Credit investigation data refers to the data that records personal credit history and related financial information, including basic personal information, income, occupation, marital status, credit card and loan information,

Tripartite data. Tripartite data refers to the data collected by the third-party data providers, such as economic data, market data, risk IP, fraudulent devices, and the list of telecom fraud mobile phone numbers, etc.

The quality and accuracy of the data is very important, risk control engine data aggregation products support different types, different call way of external channel data, not only use a large number of government, business data, and the introduction of data through multiple channels, and then unified management and data specification, solve the problem from data source access to data application, comprehensive support risk control engine demand for data application.

Dinsight: Step-by-Step Data Integration

There are many ways for risk control engines to access data. For example, the business data of the financial industry is generally connected to the internal database through SQL, the tripartite data is generally connected to the external data vendor through URL, or the external data is associated with the risk control engine by mapping and enables multiple calls to the same external data.

Take the top image Dinsight real-time risk control engine as an example, first access in the console, and then can be configured in the engine.

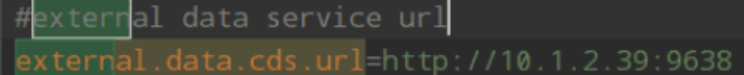

The Access Console (console), at the application.properties Configuration in:

The Access Engine (engine), in the application.properties Configuration in:

The Access Engine (engine), in the application.properties Configuration in:

Dinsight can perform risk judgment on the requests sent by the business front end in marketing activities, payment orders, credit applications and other scenarios, and return the decision result within milliseconds to improve the risk prevention and control ability of the business system. The average processing speed of daily risk control strategies is less than 100 milliseconds, the aggregate data engine, the integration of expert strategies, the parallel monitoring, replacement and upgrading of existing risk control processes, and the construction of a dedicated risk control platform for new businesses; Aggregate anti-fraud and risk control data, support multi-party data configuration access and precipitation, can be configured graphically, and quickly applied to complex strategies and models; Based on the experience reserve of mature indicators, strategies and models, as well as deep learning technology, self-performance monitoring and self-iteration mechanism of risk control can be realized; Integrated expert strategy, based on system + data access + index library + strategy system + expert implementation of actual combat; It supports parallel monitoring, replacement and upgrading of existing risk control processes, and can also build a dedicated risk control platform for new businesses.